FINANCIAL LEARNING

Retirement plans: How can dentists nearing retirement become more prepared?

Retirement planning can be daunting for dentists. Are you saving enough? Have you explored your different options? But mainly, will you...

Company 401k and Company Stock

How much of your employer’s company stock should you consider in your 401(k) account? Should an employee hold company stock in their...

Quick Fixes For Big Gaps In Your Financial Life

There are few things more professionally satisfying to a financial coach than embracing an opportunity to guide others to and through an...

6 Travel Apps That Industry Experts Swear By to Save Money

The last thing anyone wants to do is spend more money than necessary when planning a vacation. But luckily, there are plenty of great...

How to Minimize Taxes in Retirement

Retirees can follow these simple guidelines to help manage their tax situations. Everyone can benefit by minimizing their tax liability,...

MEAL KITS PROVIDE TASTY DINNERS, WITH A SIDE OF LANDFILL

MY WIFE ELISABETH wandered into the kitchen while I was testing a Blue Apron meal kit. She lifted one of the four-pound Nordic Ice bags...

Two Tax Credits Many Small Business Owners Miss –or Don’t Know About

How to take advantage of dollar-for-dollar savings, courtesy of Uncle Sam Many small business owners miss or misunderstand the power of...

4 Financial Milestones to Reach Before You Retire

Looking forward to retirement? Here are a few goals to hit first. Retirement is a period to look forward to for a countless number of...

5 Strategies for Women Entrepreneurs to Save for Retirement

Since, in general, women live longer than their male counterparts, a robust retirement savings plan is even more critical. Saving for...

What’s the Dirty Word in Your Business?

As a business owner, are you focused on how much money everyone is spending in your business? Or do you focus instead on how much profit...

You’re More Likely to Retire Wealthy if You Do This One Thing

Wouldn't it be great if there was one simple thing you could do to help you better prepare for retirement and make you feel more...

What I did on my summer vacation: 3 steps to get your retirement plan on track

Summer is around the corner and many of us should have a little more free time to tackle that list of projects we’ve been postponing....

These are the most outrageous travel fees

Sick and tired of paying outrageous travel fees that don't make any sense? Use these insider tips to avoid them. Corrections and...

Could brain cells be coaxed into fighting Parkinson’s disease? Scientific American reports on a new study

AUTHOR: Knvul Sheikh http://bit.ly/2voAGM1 For the past five decades pharmaceutical drugs like levodopa have been the gold standard for...

What IS Dementia?

Dementia is formally defined as “a chronic or persistent disorder of the mental processes caused by brain disease or injury marked by...

Planning your estate when you’ve got no children or heirs

Certified financial planner Mike Keeler has a client, a retired teacher, who saved diligently for her golden years and will leave behind...

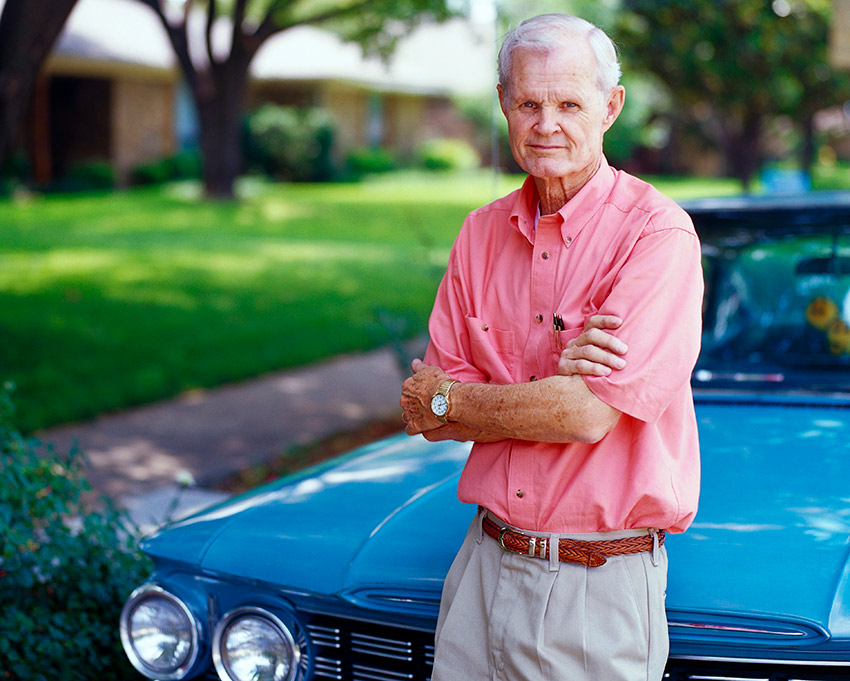

One Couple, Two Different Retirements?

After many years together, some retired spouses may find their daily routines far apart. When you see online ads or TV commercials about...

How To Use Life Insurance In Your Retirement Planning

Investing in the market without taking losses — is it too good to be true? Not according to the University of Michigan’s head coach Jim...

12 Retirement Planning Rules for People in Their 40s

Your 40s might be the most important decade when it comes to preparing for retirement. For one, you’ve likely hit your peak earning...

Is It Dementia

Dementia is currently an epidemic in America. Currently, more than 5 million Americans are living with Alzheimer’s, the most common form of...

Should Millennials Be Your Money Models?

Gen Y is doing some things right when it comes to saving & investing. Financially, Generation Y is often criticized for being risk...

Buying a House: The Five “Do’s & Don’ts” to Get a Mortgage

Getting a mortgage has become more difficult over the years. Here are some things you should and should not do to make the process...

TOP FIVE THINGS YOU Should do before moving in to a new home

Many homebuyers view their home as “a place to live.” More and more people though are looking to maximize the value of their purchase for resale...

Why Retirees Need Good Credit Scores

Careers & businesses end, but the need to borrow remains. We spend much of our adult lives working, borrowing, and buying. A good credit score...

Patience can be your ally when it comes to stock market investment.

I understand that with the recent behavior of the stock market, you may be getting impatient. You may be thinking: “What should I do? Should I do...

Life Insurance … Is It Time?

Have you been putting it off? According to the insurance industry group LIMRA and the nonprofit Life Happens, 43% of Americans have no life...

Keep Calm, Stay Invested

Expect more volatility, but avoid letting the headlines alter your plans. Recent headlines have disturbed what was an unusually calm stock market....

401(k) Plans for Healthcare Practice Employees

This may be one of the best things you can do for your financial health. If you had a chance to save hundreds of thousands of dollars over time at...

Money Milestones: This is how your finances should look in your 40s

Danny Kofke, a 41-year-old middle-school teacher outside of Atlanta, often looks at a picture of a family trip to Disney World from a few years ago...

Wow! Here’s How Many Seniors Claim Social Security at Age 70

Social Security is a program that forms the financial foundation for a majority of our nation's retired workers, and that's not expected to change...